By Horn Africa News

Mogadishu – The Federal Government of Somalia is making significant efforts to develop the country’s economy and modernize financial services in collaboration with the Central Bank, private sector stakeholders, and local business organizations.

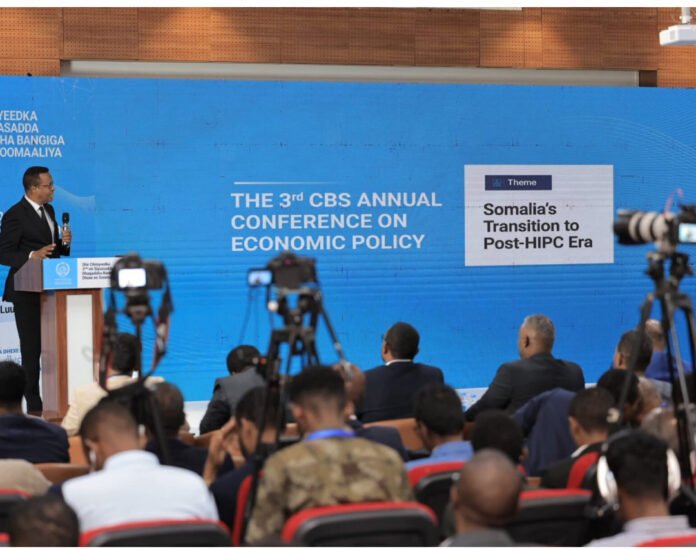

Recently, a national economic policy symposium was held in Mogadishu. This year’s forum focused on key topics such as the general state of the economy after debt relief, financial stability, improvements in government revenue, and obstacles hindering economic growth.

More than thirty organizationsparticipated in the symposium, including:

Government ministries and agencies

International institutions, such as the World Bank

Somali Bankers Association (SBA)

Somali Money Transfer Association

Somali Microfinance Association

Somali Chamber of Commerce

Insurance companies

Research institutes

National universities

Economic researchers and experts

The Governor of the Central Bank of Somalia, Mr. Abdirahman Mohamed Abdullahi, officially opened the symposium. In his opening remarks, he welcomed all participants and emphasized the Central Bank’s responsibility to offer evidence-based economic policy advice, which contributes to shaping the country’s economic direction.

Meanwhile, MP Mohamed Haruun Abdullahi, the Deputy Chair of the Senate Budget Committee, also addressed the symposium. He stressed the importance of such forums for economic reform and encouraged the Central Bank to continue its efforts in developing financial policies and working toward the reintroduction of the national currency.

Dr. Aweys Sheikh, a member of the Central Bank’s Board of Directors, delivered an important keynote on the country’s economic development process. He highlighted the importance of research-based policymaking in improving people’s livelihoods.

The symposium also featured academic panel discussions that analyzed the state of Somalia’s economy. Among the key discussions was a focus on the role of Non-Bank Financial Institutions (NBFIs) in inclusive economic development, especially in financing small and medium-sized enterprises (SMEs). The panel explored how these institutions can strengthen financial inclusion and provide affordable sources of finance.

Another academic session tackled the topic of Debt Management – Post-Debt Relief (Post-HIPC). It examined the challenges and opportunities related to budget stability and sustaining long-term economic reforms while carefully managing future borrowing.

In conclusion, the symposium was officially closed by the Director General of Services and Administration at the Central Bank, Mr. Mohamed Abdi Mohamed, who expressed his deep appreciation to all attendees. He emphasized that the insights and recommendations from the symposium will be valuable in guiding the country’s economic policy direction.