By Horn Africa News Staff

Washington, D.C. — The United States has introduced a controversial 3.5% tax on all remittances sent abroad by non-citizens, prompting concern from economists, humanitarian organizations, and immigrant communities over its potentially devastating impact on millions of families worldwide.

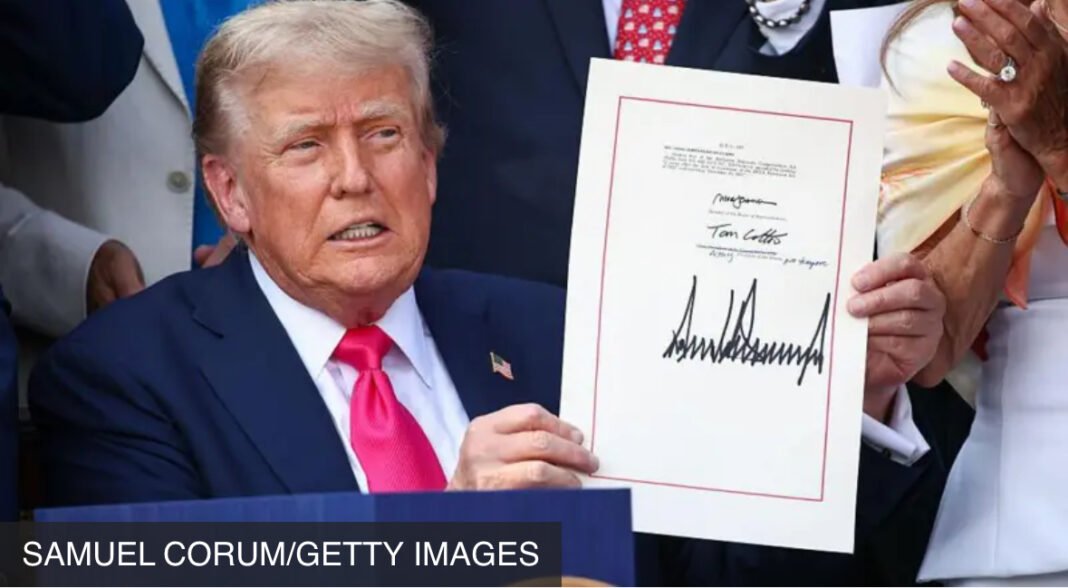

The measure, part of a broader economic package dubbed the “One, Big, Beautiful Bill,” was signed into law this month by former President Donald Trump. While billed as a revenue-boosting initiative, critics argue it disproportionately affects immigrant populations—especially those from developing nations—who regularly send money home to support their loved ones.

According to the Center for Global Development (CGD), the new remittance tax could slash global remittance flows by as much as 5.6%, translating into billions of dollars in losses for countries heavily dependent on diaspora income. Nations such as Somalia, India, Mexico, and Tonga stand to bear the brunt of the policy.

In 2023, Somalis living abroad sent an estimated $1.73 billion back home—an amount that exceeds the total foreign aid and development assistance Somalia received. With the U.S. already scaling back humanitarian aid, including a $60 billion cut by USAID, the new tax threatens to further destabilize livelihoods in vulnerable communities.

“Remittances are a lifeline,” said a spokesperson for Oxfam, referencing the critical role diaspora funds played during Somalia’s 2011 famine. “This policy risks plunging families back into crisis.”

India, the world’s largest remittance recipient with $119 billion received in 2023, also faces significant losses. As the U.S. tightens the flow of funds, questions are mounting about whether other donor nations—such as Australia or EU countries—can step in to fill the void.

The move stands in stark contrast to the United Nations Sustainable Development Goal of reducing global remittance transfer costs to below 3% by 2030. Instead, analysts warn, the U.S. tax could increase financial strain on low-income households and reverse years of progress in poverty reduction.

With the policy set to take effect within weeks, immigrant communities and humanitarian groups are urging a reconsideration, warning that the human cost may far outweigh the fiscal gain.